In simple terms, “absorption costing” refers to adding up all the costs of the production process and then allocating them to the products individually. This method of costing is essential as per the accounting standards to produce an inventory valuation captured in an organization’s balance sheet. By allocating fixed costs to inventory, absorption costing provides a fuller assessment of profitability. Since more costs are capitalized into inventory under absorption costing, the cost of goods sold recognized on the income statement tends to be lower in periods of rising production or increasing inventory levels.

Please Sign in to set this content as a favorite.

Carrying over inventories and overhead costs is reflected in the ending inventory balances at the end of the production period, which become the beginning inventory balances at the start of the next period. It is anticipated that the units that were carried over will be sold in the next period. If the units are not sold, the costs will continue to be included in the costs of producing the units until they are sold. This treatment is based on the expense recognition principle, which is one of the cornerstones of accrual accounting and is why the absorption method follows GAAP.

What’s the Difference Between Variable Costing and Absorption Costing?

However, the managers prefer marginal costing over absorption costing for managerial decision-making. Explore the fundamentals and implications of absorption costing for various industries, its role in financial reporting, and the surrounding debates. Use a different format for each (see above), however, all amounts will be the same on both statements with the exception of fixed manufacturing overhead. Overall, this statement is much easier to make if you understand product and period costs.

What is the Income Statement Under Absorption Costing? (Guidance)

- The impact of absorption costing on financial statements extends to the balance sheet, where inventory is a critical asset.

- The absorption costing income statement is also known as the traditional income statement.

- Since this method is widely used by many manufacturing companies, it is necessary yo know the advantages and disadvantages of the same.

- Once the cost pools have been determined, the company can calculate the amount of usage based on activity measures.

- Variable costing is not allowable under generally accepted accounting principles as it violates proper accounting procedures for period expenses.

Of course, this concept only generates outsized profits after all fixed costs for a period have been offset by sales. Absorption costing, also known as full costing, is a method that accounts for all manufacturing costs, both fixed and variable, in the cost of a product. It is a comprehensive approach that can significantly impact the financial statements of a company. Understanding its key principles is essential for interpreting its effects on business operations and financial outcomes. This is not right because fixed costs remain the same regardless of the units produced.

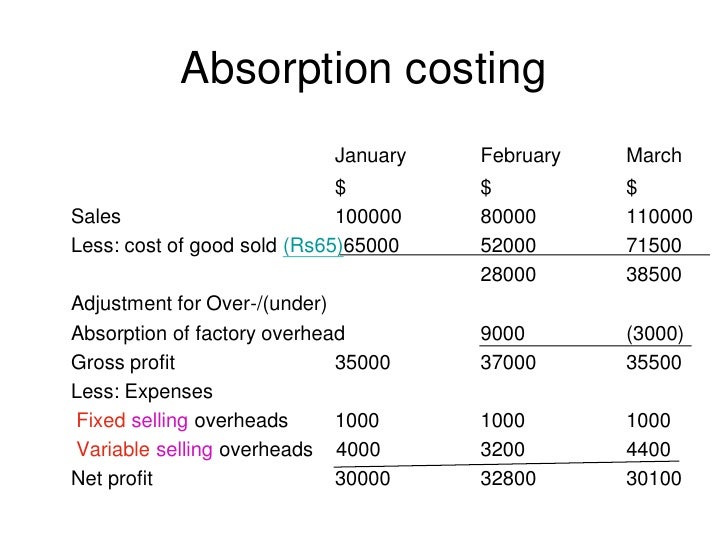

Example of Calculating the Cost of Goods Sold for the traditional income statement

While this method can lead to a more accurate reflection of service costs, it also requires careful consideration of how to define and measure service units or projects for cost allocation purposes. This is why under GAAP, financial statements need to follow an absorption costing system. As we all know, absorption costing is also known as full cost accounting because, under this method, all of them directly attributable costs of production are included.

Income Statement Under Absorption Costing: Explanation, Example, And More

It helps companies determine the full cost of producing a product or service. The most basic approach is to represent gross profit as sales minus the cost of items sold. Also, indicate the operational income equal to the gross profit minus the selling and administrative expenses. Absorption costing states that every product has a set overhead cost, regardless of whether it is sold or not during a certain period.

If absorption costing is the method acceptable for financial reporting under GAAP, why would management prefer variable costing? Advocates of variable costing argue that the definition of fixed costs holds, and fixed manufacturing overhead costs will be incurred regardless of whether anything is actually produced. In order to understand how to prepare income statements using both methods, consider a scenario in which a company has no ending inventory in the first year but does have ending inventory in the second year. Outdoor Nation, a manufacturer of residential, tabletop propane heaters, wants to determine whether absorption costing or variable costing is better for internal decision-making. It manufactures \(5,000\) units annually and sells them for \(\$15\) per unit. The total of direct material, direct labor, and variable overhead is \(\$5\) per unit with an additional \(\$1\) in variable sales cost paid when the units are sold.

Absorption costing is an inventory valuation method that allocates all manufacturing costs, including both variable costs and fixed overhead costs, to the units produced. This means that inventory is valued to include both direct costs of materials and labor as well as a portion of fixed manufacturing overhead costs. Managers who consider variable costing life for ministers after opting out of social security to sell additional units during a specific time frame add to the company’s bottom line in sales and profits because the units do not cost the company more money to produce. Variable costing does not take into account fixed or absorption costs; therefore profits are likely to increase by the amount earned through the sale of the additional item.