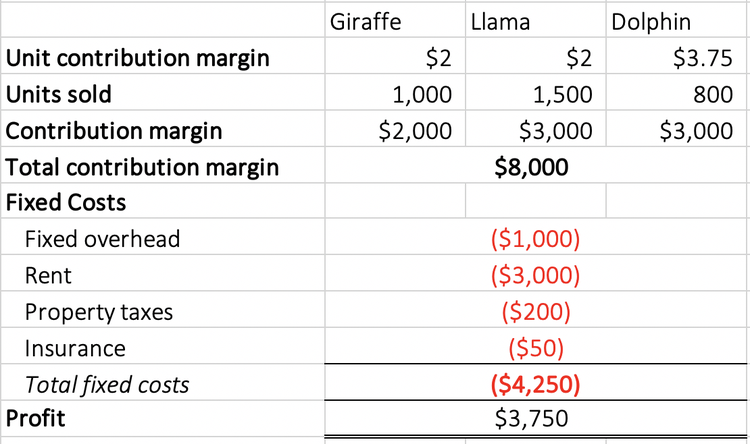

The greater the contribution margin (CM) of each product, the more profitable the company is going to be, with more cash available to meet other expenses — all else being equal. As you can see, the contribution margin per-unit remains the same. Therefore, we will try to understand what is contribution margin, the contribution margin ratio, and how to find contribution margin. This metric is typically used to calculate the break even point of a production process and set the pricing of a product. They also use this to forecast the profits of the budgeted production numbers after the prices have been set.

Contribution Margin Analysis Per Unit Example

After all fixed costs have been covered, this provides an operating profit. Labor costs make up a large percentage of your business’s variable expenses, so it’s the ideal place to start making changes. And the quickest way to make the needed changes is to use a scheduling and labor management tool like Sling.

How to Calculate Contribution Margin?

The contribution margin ratio takes the analysis a step further to show the percentage of each unit sale that contributes to covering the company’s variable costs and profit. Many companies use metrics like the contribution margin and the contribution margin ratio to help decide if they should keep selling various products and services. For example, if a company sells a product that has a positive contribution margin, the product is making enough money to cover its share of fixed costs for the company. Using this contribution margin format makes it easy to see the impact of changing sales volume on operating income. Fixed costs remained unchanged; however, as more units are produced and sold, more of the per-unit sales price is available to contribute to the company’s net income.

Contribution Margin: What it is and How to Calculate it

- Furthermore, per unit variable costs remain constant for a given level of production.

- The contribution margin ratio is a formula that calculates the percentage of contribution margin (fixed expenses, or sales minus variable expenses) relative to net sales, put into percentage terms.

- Fixed expenses do not vary with an increase or decrease in production.

- Any remaining revenue left after covering fixed costs is the profit generated.

- Contribution margin ratio is one of the most important business terms every manager needs to know but few actually do.

If the contribution margin is too low, the current price point may need to be reconsidered. In such cases, the price of the product should be adjusted for the offering to be economically viable. The companies that operate near peak operating efficiency are far more likely to obtain an economic moat, contributing toward the long-term generation of sustainable profits. You need to fill in the following inputs to calculate the contribution margin using this calculator.

With the help of advanced artificial intelligence, Sling lets you set projected labor costs before you schedule your employees so you know what the wage ceiling will be before putting names to paper. Once those values are set, you can create the perfect schedule the first time through…without going over your labor budget. The insights derived post-analysis can determine the optimal pricing per product based on the implied incremental impact that each potential adjustment could have on its growth profile and profitability.

Fixed Cost vs. Variable Cost

One way to express it is on a per-unit basis, such as standard price (SP) per unit less variable cost per unit. The fixed costs of $10 million are not included in the formula, however, it is important to make sure the CM dollars are greater than the fixed costs, otherwise, the company is not profitable. The contribution margin can help company management select from among several possible products that compete to use the same set of manufacturing resources.

Alternatively, companies that rely on shipping and delivery companies that use driverless technology may be faced with an increase in transportation or shipping costs (variable costs). These costs may be higher because technology is often more expensive when it is new than it will be in the future, when it is easier and more cost effective to produce and also more accessible. A good example of the change in cost of a new technological 11 data ownership security privacy both myob and xero ensure the privacy and innovation over time is the personal computer, which was very expensive when it was first developed but has decreased in cost significantly since that time. The same will likely happen over time with the cost of creating and using driverless transportation. In the United States, similar labor-saving processes have been developed, such as the ability to order groceries or fast food online and have it ready when the customer arrives.

This means that $15 is the remaining profit that you can use to cover the fixed cost of manufacturing umbrellas. Also, you can use the contribution per unit formula to determine the selling price of each umbrella. Contribution margin is used to plan the overall cost and selling price for your products. Further, it also helps in determining profit generated through selling your products.