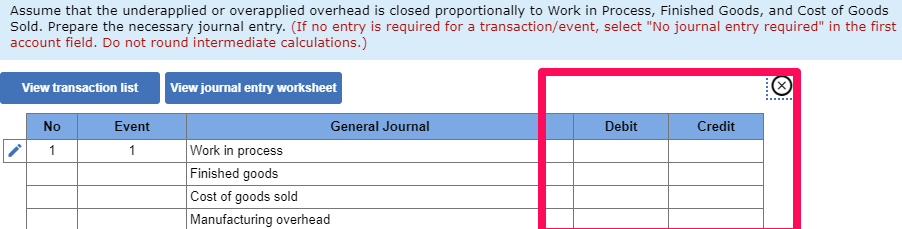

This is due to the company needs to prepare the financial statements with the actual costs that really occur during the accounting period rather than the estimation that is based on the predetermined standard rate. As the manufacturing overhead applied during the period is an estimate, there is usually an underapplied or overapplied overhead that needs to be reconciled at the end of the accounting period. Typically, the overapplied overhead is first recorded in the manufacturing overhead account. To adjust for this, an entry is made to debit the manufacturing overhead account and credit the cost of goods sold (COGS) account. This adjustment reduces the COGS, aligning it more closely with the actual costs incurred during the period.

Link to Learning

If the company booked $4,000 of estimated overhead at the beginning of the quarter, it would have to reverse the overapplied overhead, so estimated overhead booked matches the actual overhead incurred for the period. On the other hand, the underapplied overhead is the result of the applied manufacturing overhead cost is less than the actual overhead cost that incurs during the accounting period. As you’ve learned, the actual overhead incurred during the year is rarely equal to the amount that was applied to the individual jobs. Thus, at year-end, the manufacturing overhead account often has a balance, indicating overhead was either overapplied or underapplied.

Overapplied Overhead

Although those jobs are still inWork in Process or Finished Goods Inventory, companies usuallyadjust the Cost of Goods Sold account instead of each inventoryaccount. Adjusting each inventory account for a small overheadadjustment is usually not a good use of managerial and accountingtime and effort. All jobs appear in Cost of Goods Sold sooner orlater, so companies simply adjust Cost of Goods Sold instead of theinventory accounts. In this case, the manufacturing overhead is overapplied by $500 ($10,000 – $9,500) as the applied overhead cost is $500 more than the actual overhead cost that have occurred during the period. To correct for overapplied overhead, the excess amount is usually subtracted from the total cost of goods sold. If the amount of overapplied overhead is significant, it may be spread out across various inventory accounts and cost of goods sold in proportion to the overhead applied during the period.

- Even though overhead doesn’t affect cash flows, it still shows up in the bottom line or net income.

- Often as part of standard financial planning and analysis (FP&A) activities, careful review on underapplied overhead can point to meaningful changes in operational and financial conditions.

- By refining these allocation methods, companies can achieve more precise cost distribution, leading to better pricing strategies and cost control.

Manufacturing Overhead

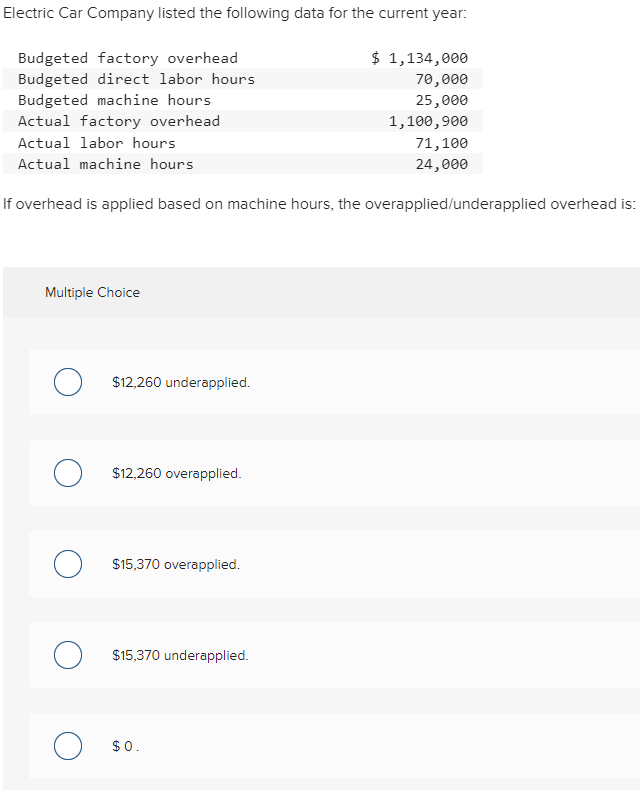

Overapplied overhead is the result of the manufacturing overhead costs that are applied to the production process is more than the actual overhead cost that actually incurs during the accounting period. Underapplied overhead occurs when a business doesn’t budget enough for its overhead costs. This means the budgeted amount is less than the amount the business actually spends on its operations. For example, when a company incurs $150,000 in overhead after budgeting only $100,000, it has an underapplied overhead of $50,000.

Moreover, overapplied overhead impacts the balance sheet by inflating inventory values. Since overhead costs are initially allocated to inventory, an overapplication results in higher inventory valuations. This can distort the true financial position of the company, as the assets on the balance sheet appear more valuable than they are. Such discrepancies can complicate financial analysis and decision-making processes, particularly when it comes to securing financing or evaluating the company’s liquidity.

This can affect a company’s perceived financial health and may influence decisions related to pricing, budgeting, and resource allocation. Because accountants have to charge expenses as they’re incurred, manufacturers don’t have the luxury of waiting until the end of an accounting period to determine their exact manufacturing overhead costs. Instead, they start with estimates based on past experience and their expectations for the future. A company might estimate that for the coming year, it will have manufacturing overhead of $250,000 and it will run its machines for a total of 13,000 hours. Underapplied overhead occurs when a company has overhead costs greater than its budgeted costs.

Overapplied overhead occurs when the allocated manufacturing overhead costs exceed the actual incurred costs during a specific period. This discrepancy can lead to distorted financial statements and misinformed decision-making if not properly addressed. Understanding the distinction between overapplied and underapplied overhead is fundamental for effective cost management. While accounting for derivatives definition, example overapplied overhead occurs when allocated costs exceed actual costs, underapplied overhead is the opposite scenario, where actual costs surpass the allocated amounts. Both situations can distort financial statements, but they require different corrective actions. Underapplied overhead typically results in understated COGS and inventory values, leading to lower reported profits.

The machine shop estimates that its overhead will be $1,000 a month for next three months. After the quarter has ended, it turns out that total overhead incurred for the last three months was $3,600—not $3,000. Now the machine shop has to book an additional $600 of overhead expense because the original estimate what under applied.

This usually happens when a business uses a standard long-term overhead rate that is based on the average amount of factory overhead that is likely to be incurred, and the average number of units produced. In some periods, either the number of units produced will be greater than expected, or actual factory overhead costs will be lower than expected. In these situations, the use of a standard overhead rate will result in overapplied overhead. For example, on December 31, the company ABC which is a manufacturing company finds out that it has incurred the actual overhead cost of $9,500 during the accounting period. However, the manufacturing overhead costs that it has applied to the production based on the predetermined standard rate is $10,000 for the period. Sometimes, the actual overhead costs for a given period might be lower than what was estimated and allocated to the cost of goods or services, resulting in what is known as overapplied overhead.